The Loan That’s Too Good to Be True? The CRA Home Loan Explained for Utah Buyers

Three Percent Down Payment, No Mortgage Insurance, Below-Market Interest Rates, and Reduced Closing Costs

In today’s high-priced housing market, finding the right mortgage program can feel like searching for a unicorn—especially in Utah, where home values have soared in recent years. But what if there was a loan program that offered a low down payment, no mortgage insurance, and below-market interest rates—even if you’re not a first-time buyer or veteran?

Introducing the Community Reinvestment Act (CRA) loan—a mortgage option that sounds too good to be true, but isn’t.

Let’s break it down.

🏡 What is the CRA Loan?

The CRA home loan is a Community Reinvestment Act-backed mortgage designed to encourage banks to invest in the communities they serve—especially in low-to-moderate income areas or among borrowers with modest incomes.

It’s not a government loan, but rather a bank-offered program that helps improve access to homeownership by offering more flexible and affordable financing options.

🕰️ A Quick History: What is the Community Reinvestment Act?

The Community Reinvestment Act (CRA) was passed in 1977 as a federal law requiring banks to help meet the credit needs of the communities where they operate—including low- and moderate-income neighborhoods.

Fast-forward to today: Banks and credit unions often offer special loan programs that count toward their CRA compliance—these programs reward borrowers with perks you won’t find in traditional mortgages.

✅ How the CRA Loan Works in Utah

The CRA loan isn’t a single, standardized product—each bank offering it may have slightly different requirements. But in Utah, the core benefits generally include:

3% down payment (or a very low down payment)

No private mortgage insurance (PMI) – a major monthly savings

Below-market fixed interest rates

Reduced closing costs

No first-time buyer requirement

Flexible credit guidelines

Available in designated areas (often in SLC, Murray, West Valley, Ogden, etc.) or based on borrower income

📍 Who Qualifies?

There are two typical ways to qualify:

By Income

If your income is below a certain percentage of the Area Median Income (AMI), you may qualify—even if the home is not in a CRA-eligible area.By Location

If the property is in a CRA-eligible census tract (a lower- to moderate-income area), you may qualify regardless of income.

The by-location qualification has the highest financing success rate, and the homes in these areas typically build equity fast. I’ve seen homes in these areas appraise $5,000 and $10,000 above purchase price.

👉 In Utah, many parts of Salt Lake City, West Valley City, Murray, South Salt Lake, and sections of Ogden and Provo fall within CRA zones.

💵 Real-World Example: Buying a $400,000 Home with a CRA Loan

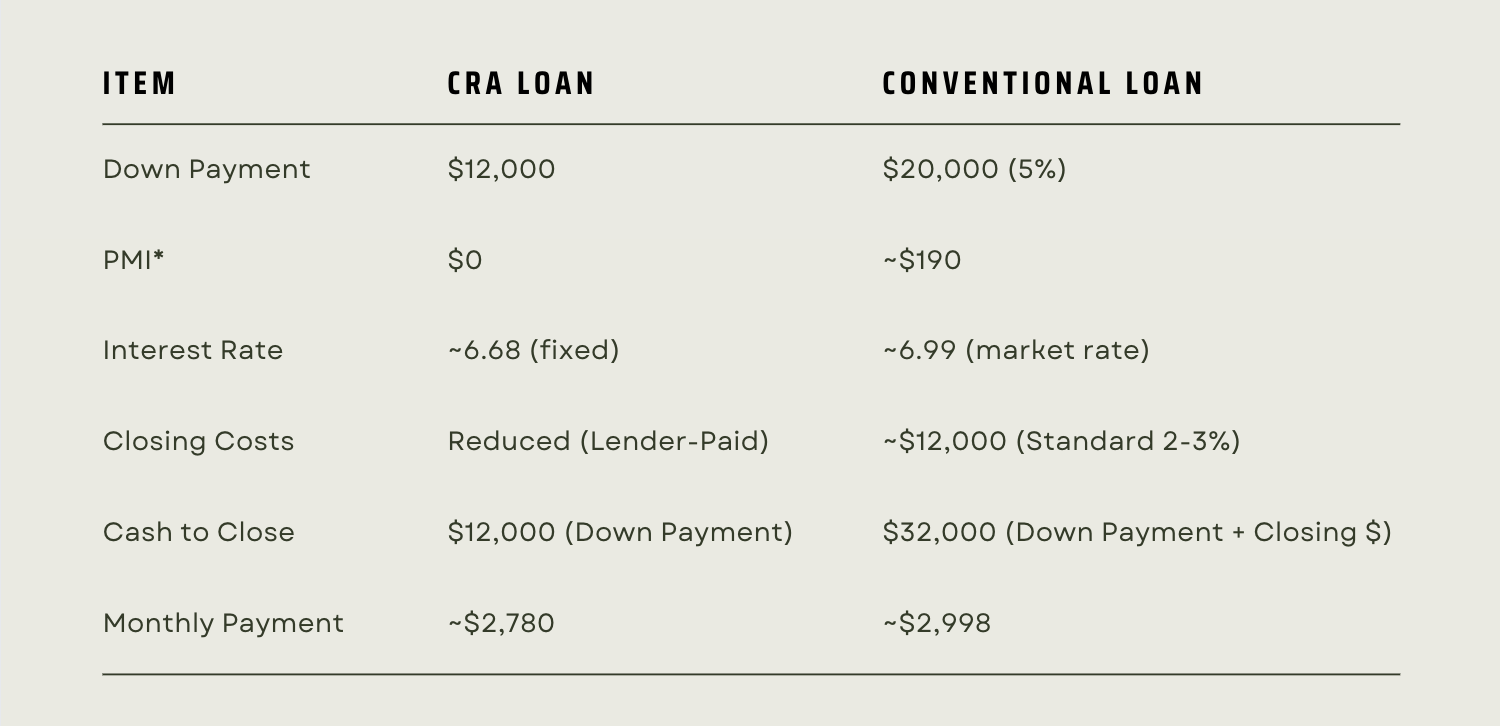

Let’s compare a CRA loan to a typical conventional loan for a $400,000 home in Salt Lake County:

* Private Mortgage Insurance

That’s a monthly savings of over $200—and $20,000 less needed to close on the home. For many Utah buyers, that can be the difference between renting and owning.

📋 Documents You’ll Typically Need:

W-2s and paystubs (or tax returns if self-employed)

ID and Social Security card

Proof of assets (bank statements, etc., even though most programs don’t require a large down payment)

A soft or full credit check (minimum score is usually flexible—some allow as low as 620)

🏦 Which Banks in Utah Offer CRA Loans?

Several banks and credit unions participate in CRA lending programs, including:

Zions Bank

KeyBank

U.S. Bank

First Utah Bank

Each lender has its own version of the program, so it’s worth comparing your options or asking your real estate agent to help you find the right match. I’ve had 3 clients utilize the program with Zions this year alone—ask me about connecting you with my preferred loan officer.

🧠 Final Thoughts

If you're a Utah homebuyer who’s been sidelined by rising prices or discouraged by hefty down payment requirements, a CRA loan might be the tool that gets you into a home—sooner than you think.

While it may sound too good to be true, this is a real, bank-backed, and federally-supported program that could save you thousands up front—and every single month thereafter.

Want help figuring out if a property qualifies? I’d love to walk you through it and connect you with a lender offering CRA loans in your area.

Let’s turn “too good to be true” into “too good to pass up.”

📲 Reach out today and let’s start your homeownership journey!

Hi. I’m Erin.

My first passion is my family: my 3-year-old, my partner, and my two dogs. My second passion is reaching the moment when my clients realize that their next phase in life is a reality, that it’s really happening—they have successfully bought or sold a home.

It's a great honor to be an advisor during the home-buying or selling process, and I'm dedicated to navigating the market with my clients every step of the way, from pre-approval, to financing, to location strategy, to selecting the perfect place to call home.

As a Millennial and survivor of the 2008 recession, I deeply understand the emotional nature of homeownership and wealth-building. With honesty and integrity at the forefront, I seek to educate and empower my clients through clear communication, transparent advice, and experience-driven data, ensuring they're able to make confident, timely decisions.

Hope to hear from you soon,

Erin Maresko

(385) 302-2973

erin.maresko@theperry.group

The Perry Group | REAL Broker, LLC