Buyers: Utah Inventory Has Reached a Post-Pandemic High. Here’s What to Do.

A New Buyers’ Market

There are more homes hitting the market, sellers are negotiating, and the tides are finally turning in favor of buyers in the Wasatch Front. This is the window that buyers, especially first-time homebuyers, have been waiting for.

But Why?

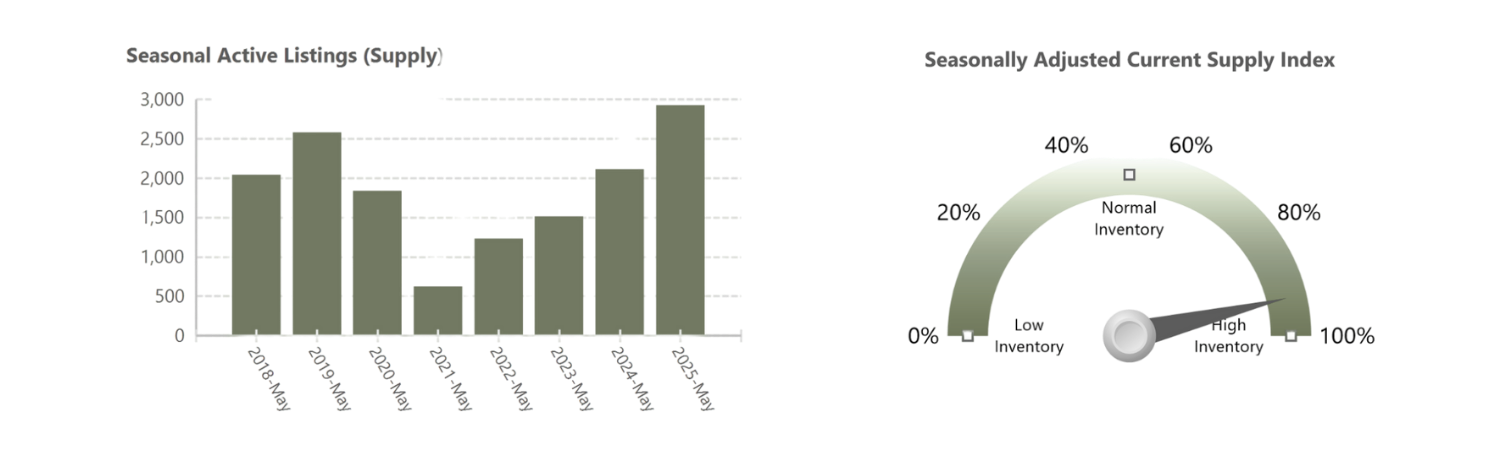

Increased Inventory: The number of homes for sale in Salt Lake County rose significantly over the last 90 days from 2,250 in March to 3,188 in May—a 41% increase. This represents the highest number of homes on the market since the Pandemic ended.

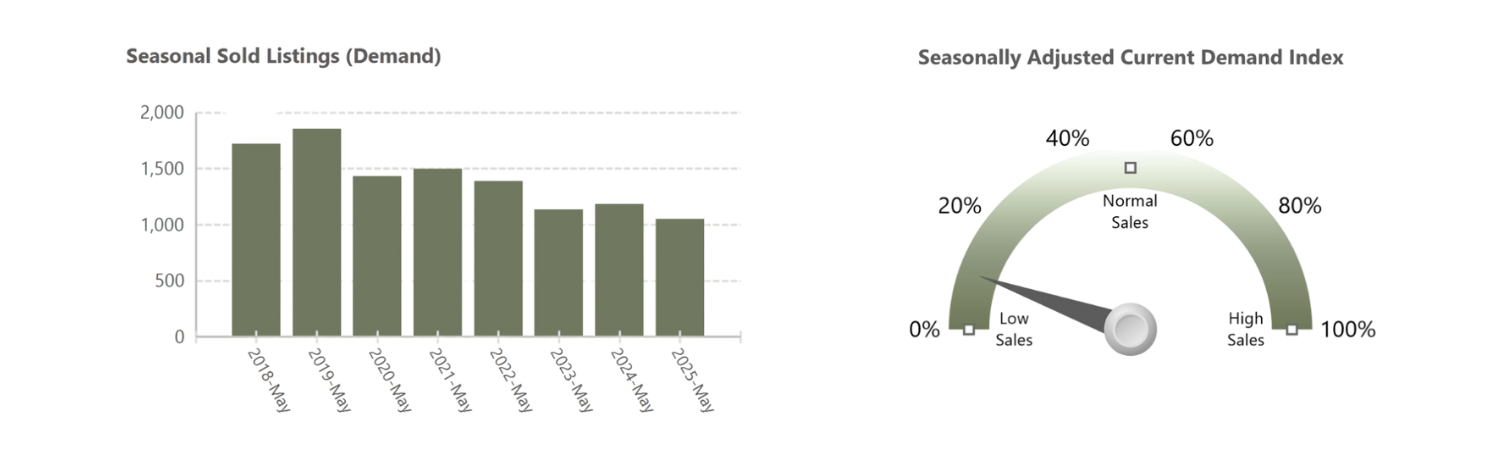

Increased Days on the Market: The quicker homes go under contract, the more buyers need to act quickly and decisively. The longer homes spend on the market, the more time and control buyers have. Homes are staying on the market about 4.5 times as long as back in 2021.

These charts demonstrate the exponential rise in inventory since the end of the Pandemic. Source: Utahrealestate.com.

These charts demonstrate the decline in the pace of sales since the end of the Pandemic, a major factor in the rise of inventory competition. Source: Utahrealestate.com.

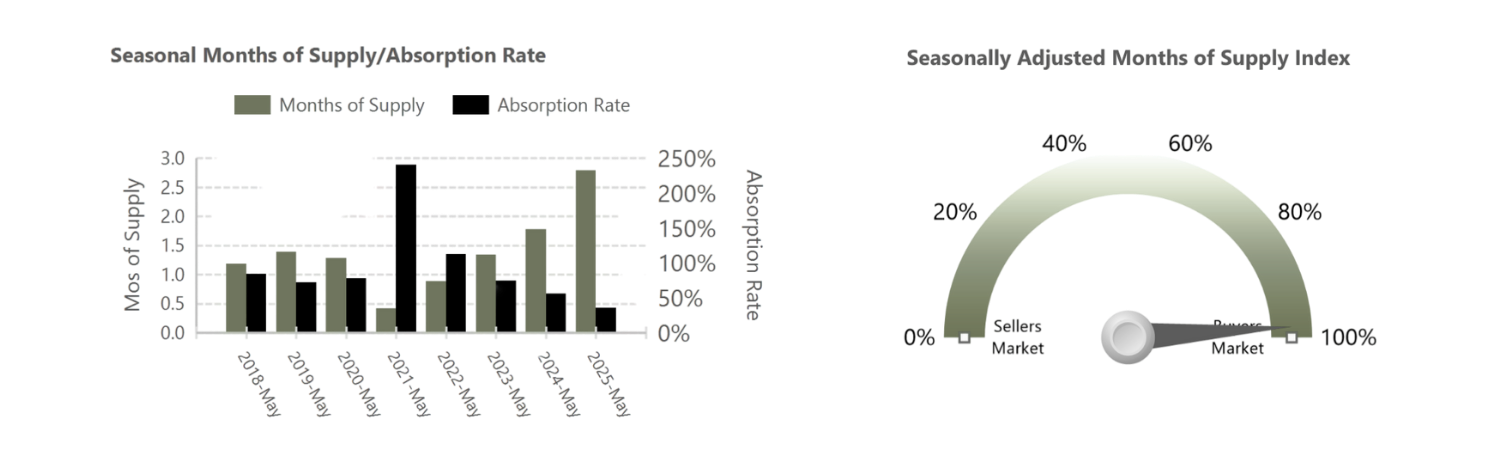

These charts show a side-by-side comparison of supply and demand, a complete flip flop since the end of the Pandemic. Source: Utahrealestate.com.

What to Expect

Price Reductions: Throughout 2025, 34.4% of active listings in Salt Lake County experienced price reductions, the highest rate recorded since tracking began. Most industry professionals believe that this trend will continue in the coming months as pricing self-regulates.

Concessions: Beyond the price of a home and your down payment, closing costs like mortgage and title fees can significantly impact your ability to come up with enough cash to close the transaction. These expenses are often $10,000 to $15,000. However, sellers in a buyers’ market are increasingly likely to offer up cash toward those costs or, in some cases, to buy down your interest rate for a reduced monthly payment.

Home Prices to Self-Regulate: With an increase in price reductions and more competitive sellers, comps simply won’t support the pace at which home prices have been rising in Salt Lake over the past few years. This means that, in order to stay competitive and sell quickly, sellers will have to hit the bullseye on their pricing to not only stay relevant, but to appraise at the right value for buyers to get a loan to cover the full amount.

Interest Rates to Come Down: Woo hoo! Eventually, the market will slow down if home inventory continues to grow. To keep things moving, interest rates will naturally adjust to bring more buyers to the table. We’re not talking a huge swing here immediately, but you should see some relief in the latter half of the year. However, I always recommend choosing the right time to buy a home based on your individual situation and financial ability. Time in the market is always more advantageous than timing the market—home prices will continue to rise as they have since the dawn of time!

What to Do

Take Your Time—but Not Too Much

You no longer need to make an offer within hours of a showing, but that doesn’t mean you should be idle. Well-priced, well-presented homes can still move quickly, especially in desirable neighborhoods. Showing interest in a home and delaying your offer can easily result in a multiple-offer situation as listing agents leverage your interest against others.

Pro Tip: Find an agent who can help you get pre-approved with a vetted lender, then be ready to move when the right opportunity presents itself.

Negotiate With Confidence

In a buyer’s market, sellers are more open to concessions. This could mean negotiating on price, asking for closing cost assistance, or requesting that appliances or repairs be included in the deal. However, as sellers adjust to the changes in the market, you can expect their original pricing to be a more accurate representation of value. Offering at asking price, once the value is confirmed, will still be common here in Salt Lake. Agents are still in the habit of downplaying the possibility of concessions, so stand firm.

Pro Tip: Work with a knowledgeable agent who understands the local market and can help you craft a compelling but realistic offer.

Look for Price Reductions

Many sellers are still adjusting to the new reality. Homes that were initially overpriced may have had recent price drops. These can be great opportunities to get into a home that was once out of budget.

Pro Tip: Ask your agent to set alerts for homes that have had multiple reductions—those sellers are often the most motivated.

Don’t Skip the Inspection

In the frenzy of past markets, some buyers waived inspections just to compete. In today’s market, you can—and should—do your full due diligence.

Pro Tip: Use the inspection as an opportunity to request necessary repairs or negotiate the price further if issues arise.

Focus on Long-Term Value

A slower market gives you the breathing room to evaluate neighborhoods, school districts, commute times, and future resale potential.

Pro Tip: Prioritize location, condition, and layout over flashy finishes. Cosmetic updates are easy; bad locations aren’t.

What Do I Do if I’m a Seller?

For smart, strategic sellers, this market shift isn’t all gloom and doom. Discover winning strategies for sellers in a buyers’ market here →